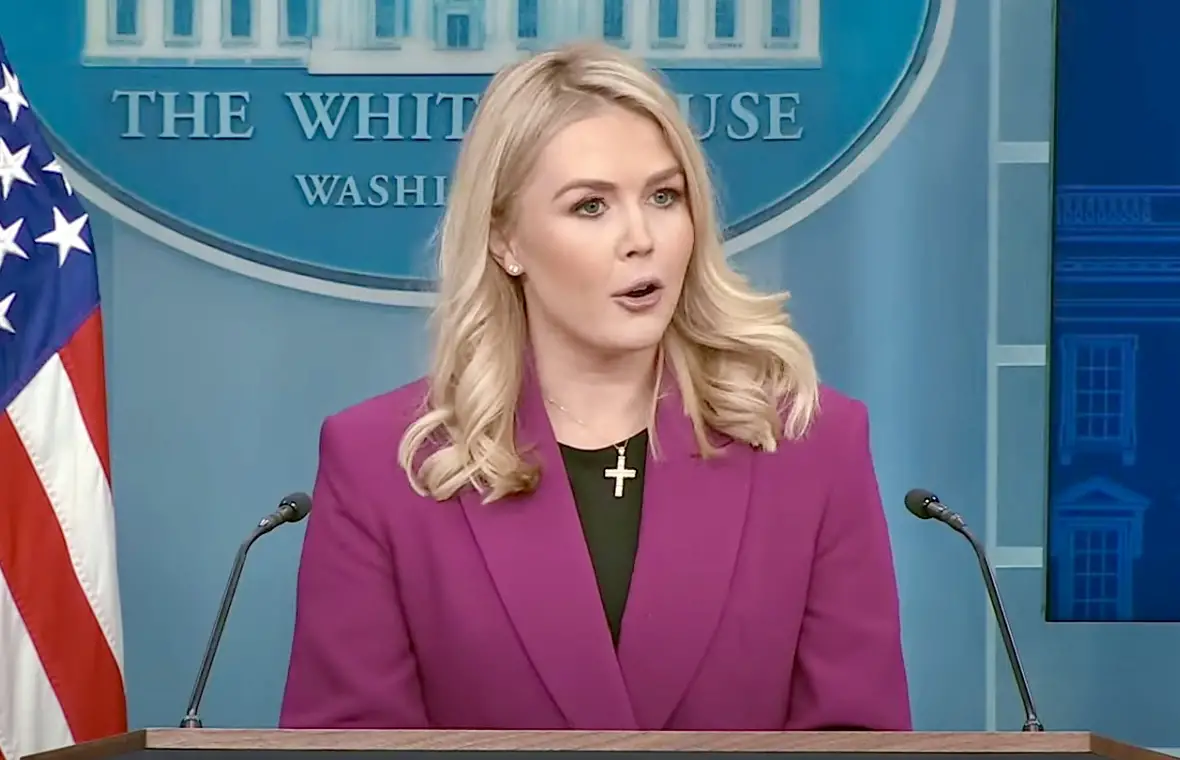

In a bold new announcement, White House Press Secretary Karoline Leavitt recently outlined a series of sweeping tax reform proposals put forward by the Trump administration. During a press briefing, Leavitt detailed plans that would see the removal of taxes on several key income sources, including Social Security benefits, senior income, overtime pay, and more. These initiatives are being hailed by supporters as potentially the largest tax cuts in history for middle-class Americans.

Speaking directly to reporters, Leavitt emphasized the administration’s commitment to reducing the tax burden on everyday citizens. “These are the tax priorities the President has laid out for today’s meeting,” she stated. “We are eliminating taxes on tips, Social Security, and overtime pay, and renewing the middle-class tax cuts first established in 2017.” According to Leavitt, the focus is on removing unnecessary tax obligations that have long weighed down American workers and seniors.

One of the central pillars of the proposal is the elimination of taxes on Social Security benefits. Under current law, many senior citizens are required to pay income taxes on a portion of their Social Security income—a measure that critics argue unfairly penalizes those on fixed incomes. The Trump administration’s plan would remove this tax, offering immediate relief to millions of retirees. Leavitt added, “No tax on seniors and Social Security is a promise that resonates with our senior citizens, who have worked hard all their lives and deserve a tax break.”

The proposal doesn’t stop there. Leavitt also mentioned plans to adjust the State and Local Tax (SALT) cap, a move intended to ease the burden on middle-class families who often pay a significant portion of their income in local taxes. In addition, she detailed efforts to eliminate special tax breaks that have long benefited billionaire sports team owners, close the carried interest tax deduction loophole, and introduce additional tax cuts for products made in America. “These measures, taken together, represent the most aggressive tax cut initiative in our nation’s history for working Americans,” Leavitt said.

The overarching goal of the administration’s proposal is to achieve historic levels of savings for the federal government and, in turn, for taxpayers. Leavitt noted that the plan is not just about cutting taxes, but about stimulating economic growth by allowing middle-class families to retain more of their hard-earned money. “We are focused on maximizing savings for every American, ensuring that our tax system rewards work and ingenuity instead of penalizing it,” she explained.

This ambitious strategy builds on previous statements made by President Trump during interviews on Fox News Channel’s “Fox & Friends.” In one memorable exchange, Trump suggested that there might be a path to entirely eliminate federal income tax, citing historical examples from the late 19th century. “Back in the 1890s, our nation thrived without an income tax thanks to tariffs and other sources of revenue,” Trump remarked. He went on to note that in those days, America enjoyed unprecedented prosperity, implying that a modern return to such a system could be within reach.

During that interview, Trump posited that once the country regains its financial footing and generates substantial revenue from tariffs and other economic measures, there could be a possibility of eliminating income taxes altogether. “In the old days, we had so much money that committees were formed just to figure out how to spend it,” he said, drawing a contrast with today’s fiscal challenges. The implication is clear: by significantly cutting taxes, especially on items like Social Security and overtime pay, the administration hopes to boost economic activity and create a more favorable environment for growth.

Critics of the plan, however, caution that such sweeping reforms could have complex consequences for federal revenue and public services. They argue that while tax cuts for middle-class families are undoubtedly popular, the broader fiscal impact must be carefully managed to avoid long-term deficits. Nonetheless, supporters contend that these measures are a necessary step to revive the American economy and alleviate the financial strain on millions of families.

As the Trump administration moves forward with its proposed tax reforms, all eyes will be on Congress to see if these bold ideas can be translated into law. The promise of unprecedented tax relief for working Americans is a powerful political message, one that could reshape the fiscal landscape of the country in the years to come.